I didn’t receive Form 1095-A.

There are a couple of reasons why you might not get Form 1095-A.

You were not enrolled in a Qualified Health Plan.

Form 1095-A is only provided to people who enrolled in a Qualified Health Plan (QHP) through Access Health CT at the Bronze, Silver and Gold levels. If you were enrolled in a Catastrophic health plan or if you only had a Stand-Alone Dental Plan, you will not receive Form 1095-A.

You had HUSKY Health coverage.

If you had HUSKY Health (Medicaid or Children’s Health Insurance Program) coverage last year, you will not receive Form 1095-A from Access Health CT. Instead, you can request Form 1095-B from the Connecticut Department of Social Services (DSS). Form 1095-B is no longer required by federal law when preparing federal income tax returns and it will not be mailed to you automatically. However, you can request it from DSS in one of the following ways:

- Online: ct.gov/ctdss1095B

- By Phone: HUSKY Health 1095-B Information Center, 1-844-503-6871. Monday through Friday from 8 a.m. to 5 p.m.

- By Mail: Send the name, dates of birth, Social Security numbers, client identification numbers and return addresses for each person requesting the form to:

The HUSKY Health 1095-B Information Center

P.O. Box 280747

East Hartford, CT 06128-0747

You are a dependent on someone else’s plan.

If someone can claim you as a dependent, you will not receive your own Form 1095-A. Instead, you will be listed as a covered individual on the primary account holder’s form.

If you believe you should have received Form 1095-A or if you believe there is an error on your form, please contact us right away. You can call us at 1-855-805-4325. If you are deaf or hearing impaired, you may use the TTY at 1-855-789-2428 or contact us at 1-855-805-4325 with a relay operator.

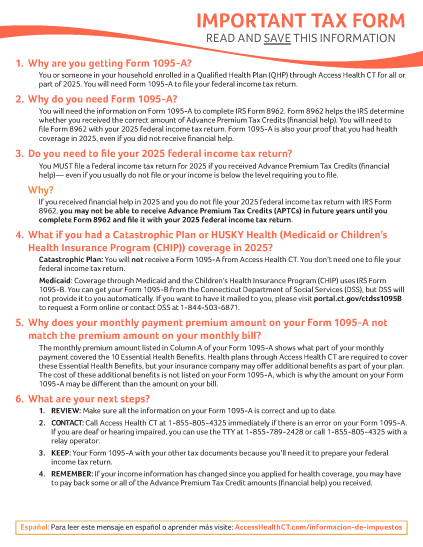

Understanding your Form 1095-A.

If you opted in to exclusively receive Form 1095-A electronically, we will upload your Form 1095-A to your Access Health CT account. If you did not opt in, we will mail Form 1095-A to you. If you have an Access Health CT account, we will also upload a copy of your mailed Form 1095-A to your account. You can opt in to receive electronic notifications by signing in to your account. Select “Edit My Settings” and then choose “Update Contact Information.”

If you are locked out of your account or if you need to create one, call us at 1-855-805-4325. If you are deaf or hearing impaired, you may use the TTY at 1-855-789-2428 or contact us at 1-855-805-4325 with a relay operator.

When you sign in to your account, click “Get My Tax Forms” to download or view your Form 1095-A. If you can’t find it, click on “Read My Messages” and then search for “1095” in the search bar.

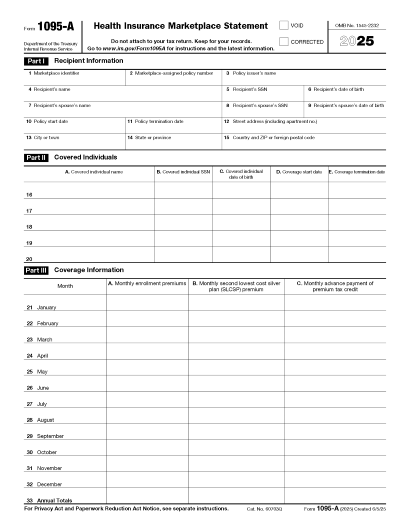

Form 1095-A will show:

- Who had qualified coverage in your household.

- The start and end dates of your coverage.

- Your household’s plan information and monthly payment (known as a premium).

- The amount of money paid to your insurance company to help lower your monthly costs (known as Advance Premium Tax Credits or APTCs).

Next steps after you receive Form 1095-A:

- Check the information on your Form 1095-A. Make sure the information is correct for everyone covered by your health plan, including names, home address, health plan information and Advance Premium Tax Credit (APTC) amounts, if applicable. If any of the information on Form 1095-A is wrong, please call us at 1-855-805-4325. If you are deaf or hearing impaired, you may use the TTY at 1-855-789-2428 or contact us at 1-855-805-4325 with a relay operator.

- If you received Advance Premium Tax Credits, download IRS Form 8962. If you received Advance Premium Tax Credits (APTCs), you must file Form 8962 with your federal income tax return. The IRS will use this form to determine whether you received the correct amount of tax credits. If your income information changed between the time you applied for health coverage and when you file your federal income tax return, you may have to pay back some or all of the tax credits you received. If you don’t file Form 8962 with your federal income tax return, you may not be able to receive APTCs in the future. Download Form 8962 from the IRS.

- File your federal income tax return. Make sure you have Form 1095-A before you file your federal income tax return to prevent processing or refund delays. If you received financial assistance (APTCs), use the information on Form 1095-A to fill out Form 8962. A tax professional can help you understand and complete your federal income tax return.

Frequently Asked Questions

I received financial help (APTCs) in the previous plan year. Should I file a federal income tax return?

YES. You must file a federal income tax return for the previous plan year even if you usually don’t file or if your income is below the level requiring you to file.

What should I do if my tax return was rejected for missing Form 8962?

If you filed your federal income tax return electronically and it was rejected for missing Form 8962, you may need to resubmit your return with the form or an explanation for why you are missing the form and then attach it to the return when you refile. Learn how to fix it and correctly file electronically.

The monthly payment (premium) amount on my Form 1095-A DOES NOT match the premium amount on the bill I received from my insurance company every month. Is this an error?

Not necessarily. The premium amount in Column A of your Form 1095-A may show a different amount because amounts in Column A show only the part of your premium that covers the 10 Essential Health Benefits. Insurance companies may offer benefits in addition to these Essential Health Benefits. A difference in your premium may be to cover these additional benefits.

There’s an amount listed in Column C on my Form 1095-A, but Columns A and B are blank. Is this an error?

This is a common situation if you receive financial help to lower your costs but missed paying your insurance bill for one or more months. Your insurance company gives you a grace period for those months, but the IRS still records the tax credits you received. You’ll see this number in Column C, but Columns A and B will be blank on the months that weren’t paid.

Could I owe a penalty?

It depends. The penalty or fee for not having health insurance coverage ended in 2019. That means you won’t have to pay a fee for not having coverage in 2025. However, if your household income changed and you received more Advance Premium Tax Credits than you should have, you may have to pay back some or all of those credits to the IRS.

I thought I needed Form 1095-C?

Form 1095-C is for people who had coverage through their employer or through Medicare. If you purchased health coverage through Access Health CT, you will receive Form 1095-A instead.

Latest from the blog

New financial help could lower your health coverage costs in 2026

The cost of health care is a worry for a lot of people. You may be able to lower how much you have to pay each month for your health insurance with new financial help called 2026 Temporary Premium Assistance. This is additional financial help you can use to lower your...

Why updating your income could save you from a tax time surprise

If you use financial help to lower the cost of health coverage, it is important to let Access Health CT know if your household income changes. You must keep your information updated to avoid a surprise bill when you file your federal income tax return.How does...

Making the move to Medicare: What to expect when you turn 65

Turning 65 is a milestone many of us look forward to. It might mean a chance to retire or to use a senior discount. For most people, turning 65 also means you can sign up for Medicare. And if you have a health insurance plan through Access Health CT, there are a few...

Turning 26? Your guide to enrolling in health coverage

16, 18, 21 – these are all milestone birthdays. But did you know your 26th birthday is also an important one when it comes to taking care of your health? The Affordable Care Act (ACA) allows young adults to stay on their parents’ health insurance plans until they turn...

Boost your health insurance plan with a Health Savings Account (HSA)

Health Savings Accounts, or HSAs, are another tool you can use to manage your health care costs. If you have a Bronze or Catastrophic Plan through Access Health CT, you can open your own HSA. The money you put into an HSA can be used to pay for health care costs,...

Get Free In-Person Help

Access Health CT (AHCT) helps Connecticut residents when and where they need it. We hold different kinds of enrollment events in places where people can get one-on-one help with their applications for health and dental coverage. The best part is that all help is free...